Tax Increment Financing (TIF)

Tax Increment Financing (TIF) is a development tool local governments can utilize to make public improvements and attract new development to a specific area. TIF Districts offer the opportunity for municipalities to attract private development and new businesses to areas that have not experienced the level of growth or development expected by the municipality while utilizing local resources that do not depend upon an increase in taxes or the reduction of other services. This investment, both public and private, means more revenue to help a community meets its other needs.

When an area is designated as a TIF district, the amount of property tax the area generates is set as a base EAV (Equalized Assessed Valuation) amount. The EAV is the county Assessor’s way of assigning similar taxes to similar structures and spreading property tax burden equally. As property values increase, all property tax growth above that amount can be used to fund redevelopment projects within the designated TIF district. The increase, or increment, can be used to pay back bonds issued to pay upfront costs, or can be used on a pay-as-you-go basis for individual projects. At the conclusion of the 23-year period all property taxes are collected at the increased levels and the increment is no longer collected.

History of TIF Districts

In the 1960’s and 1970’s, the federal and state governments, including Illinois, began cutting back economic development programs that municipalities could utilize to revitalize their communities. TIF districts are one of the few remaining tools that local governments can use to attract new businesses, invest in infrastructure and rebuild blighted areas. TIF districts are a popular and effective redevelopment tool currently utilized in 47 states across the country and over 250 Illinois communities.

For more information on the history, and laws governing TIF districts, please visit the Illinois Tax Increment Association.

Central Cary Tax Increment Financing District (TIF #3)

Established: 2023

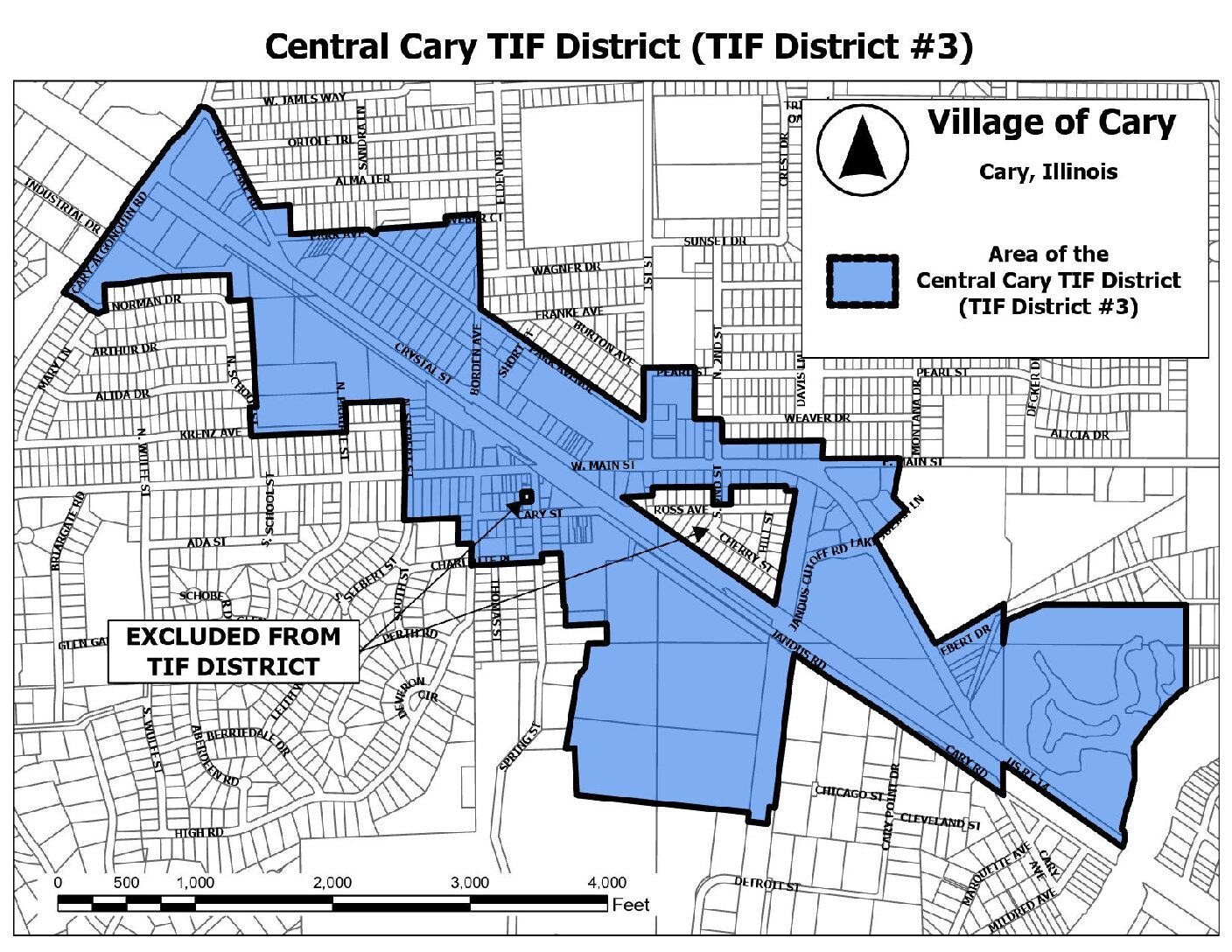

The Village of Cary currently has one active TIF district which is referred to as the Central Cary Tax Increment Financing District (TIF #3). The Central Cary TIF District consists of an area located along the US Route 14 corridor within the original 1893 corporate limits of the Village of Cary, and generally bounded by Cary-Algonquin Road on the West; Silver Lake Road, Park Avenue, Pearl Street, East Main Street, and Spring Beach Way on the North; the Fox River on the East; and Cary Road, Charlotte Place, Krenz Avenue, and Norman Drive on the South. The Central Cary TIF District was formally adopted in August 2023.

The Central Cary TIF currently contains a mix of commercial, retail, industrial, institutional, and residential buildings across 253 tax parcels. Forty-three (43) percent of the structures within the TIF area are over 100 years old. The Central Cary TIF District is intended to assist the Village of Cary with the implementation of directives from the Village’s 2015 Comprehensive Plan and the 2021 Downtown Cary Strategic Plan. The Central Cary TIF District incorporates parcels which were originally part of the expired Route 14 TIF (TIF #1) and the Cary Station TIF (TIF #2).

To view a full map of the boundaries of this TIF, please click here.

Cary Station Tax Increment Financing District (TIF #2)

Established: 2006

Closed: 2023

The Cary Station TIF District (TIF #2) was created in 2006 related to a proposed redevelopment project of the properties fronting Route 14 within downtown Cary. Due to the severe economic recession which occurred in 2008 shortly after the TIF was created, the redevelopment project did not move forward. Ultimately, the equalized assessed value of all properties within the TIF declined to levels below when the TIF was originally created. As a result the TIF failed to produce sufficient increment to support private reinvestment into the area. The Village officially terminated TIF #2 in 2023 and redistributed the TIF’s surplus funds back to local taxing jurisdictions.

Northwest Highway Tax Increment Financing District (TIF #1)

Established: 1997

Expired: 2021

The Northwest Highway TIF District (TIF #1) was created in 1997 assist with spurring development on the eastern gateway area of the Village of Cary. The TIF encompassed land along the Route 14 corridor between the Fox River and intersection with East Main Street. Notable projects that occurred within the TIF included the redevelopment of the Millers Hill Subdivision and construction of the CVS Pharmacy, reconstruction of Jandus Cutoff Road, sidewalk improvements along Route 14, clean-up of the Selcke property and the construction of a regional lift station to serve future commercial development. In total the TIF was able to assist with over $2.3 million of improvements within the redevelopment area. TIF #1 was officially closed at the end of its 23-life cycle in 2021.